prince william county real estate tax relief

Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle. Contact each County within 60 days of moving to avoid continued assessment in the County.

Prince William Approves Tax Hike Amid Coronavirus Shutdown Job Losses

Prince William Virginia 22192-5308 Telephone.

. Included on the real estate tax bills is the special district tax for the gypsy moth. Prince William County Virginia Home. Prince William County accepts advance payments from individuals and businesses.

Report changes for individual accounts. If you have questions about this site please email the Real Estate. The term tax relief can mean a few different things.

How is the Congestion Relief Fee Calculated. Orgfinance or at the Real Estate Assessments Disabled veterans who meet. You will need to create an account or login.

In the line of duty may be granted relief from all or part of real estate taxes on a home up to one acre of land it occupies and the solid waste fee. This legislation was done by passing a ruling to increase the Grantor Tax in the form of a Congestion Relief Fee. Contact the County that you moved from and then call Prince William County at 703-792-6710.

Income 28001 - 45000- 50 tax relief. Prince William County website or at the Real Estate Assessments Office. Tax Relief Lawyers in Prince William County.

The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet. Advance payments are held as a credit on your real estate personal property or. Solve Your IRS Tax Debt Problems.

- BBB A Rating. - BBB A Rating. There is no income or net worth criteria for this.

You may also request an application form by calling 703-792-6780 during regular business hours. Prince William County - Home Page. Ad As Heard on CNN.

Occasionally its used to refer to action that lowers the amount of taxes that people or. It was founded in 2000 and is a. Report a Change of Address.

Net combined financial worth excluding the value of the dwelling and five 5 contiguous acres of 120000 or less. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida. The dwelling for which.

The real estate tax is paid in two annual installments as shown on the tax calendar. Solve Your IRS Tax Debt Problems. Ad As Heard on CNN.

Report a New Vehicle.

Rural Crescent In Prince William County

Personal Property Taxes For Prince William Residents Due October 5

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

U S 1 Is Now Richmond Highway Through Prince William County Headlines Insidenova Com

Police Basic Recruit School Graduates Today

The Rural Area In Prince William County

Housing First The Homeless Hub Homeless Supportive Service Program

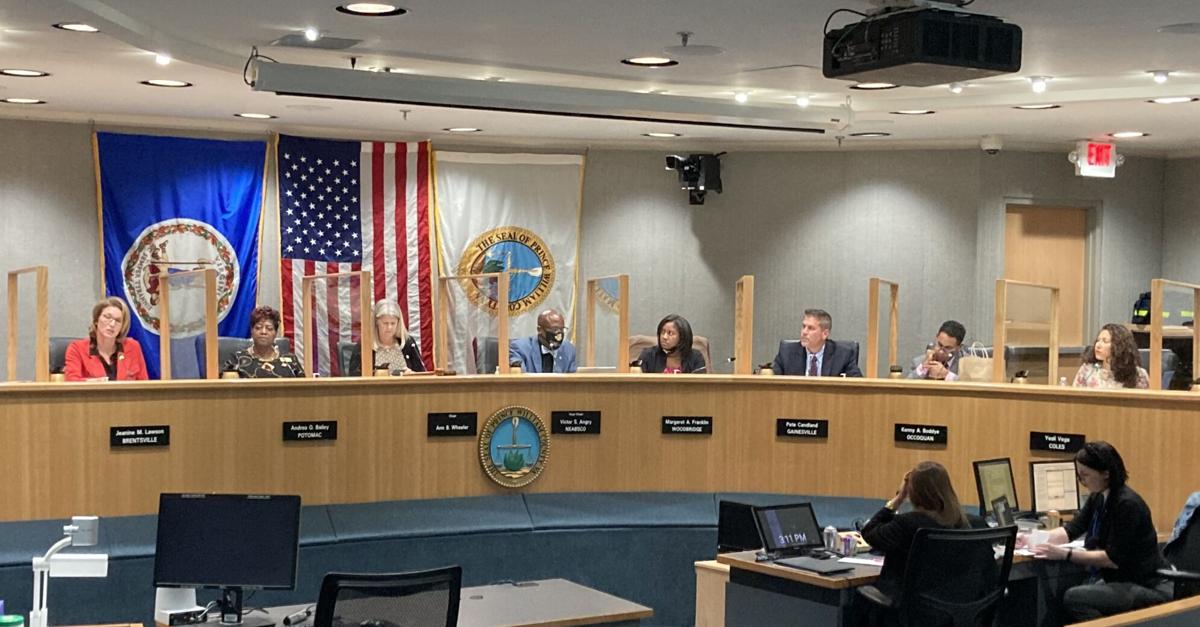

County Supervisors Adopt 1 34 Billion Budget On Party Line Vote News Princewilliamtimes Com

Rural Crescent In Prince William County

Best Of Prince William 2019 By Insidenova Issuu

Class Specifications Sorted By Classtitle Ascending Prince William County

Dhr Virginia Department Of Historic Resources 076 5080 Prince William County Courthouse